If you’re feeling overwhelmed by IRS letters, wage garnishments, or back taxes piling up — you’re not alone. Millions of Americans find themselves in tax debt each year, often through no fault of their own.

The good news?

Tax relief programs exist to help you get back on track — legally and realistically. In this guide, you’ll learn how tax relief works, whether you qualify, and what to do next.

🧾 What Is Tax Relief?

Tax relief is a general term for government programs or negotiated solutions that help reduce, settle, or manage unpaid taxes.

It doesn’t mean your entire tax debt will magically disappear.

But it can mean smaller payments, reduced penalties, and even settling for less than you owe — if you qualify.

✅ What Tax Relief Can Help You Do:

-

Stop wage garnishments and bank levies

-

Reduce IRS penalties and interest

-

Settle your debt for less (in some cases)

-

Get on an affordable monthly payment plan

-

Pause collections during financial hardship

🧠 Pro Tip: The IRS wants to collect, but they’ll work with you if they see you’re making a genuine effort.

🔎 How Does It Work with the IRS?

Most relief programs go through the IRS Fresh Start Initiative, launched in 2011 and still active in 2025. This initiative expanded access to:

-

Offer in Compromise (OIC) – settle for less than you owe

-

Installment Agreements – structured monthly payments

-

Penalty Abatement – request reduction in IRS penalties

-

Currently Not Collectible (CNC) – temporary pause in collections

These programs aren’t automatic. You’ll need to apply, provide financial documentation, and sometimes negotiate through a tax professional to get approved.

👤 Who Needs Tax Relief?

You might be wondering, “Is tax relief even for someone like me?”

If you owe $10,000 or more to the IRS or your state — and you’re struggling to pay — then yes, tax relief could help.

Here are common scenarios where relief may apply:

📌 You Might Need Tax Relief If:

-

You received an IRS notice about unpaid taxes or collections

-

Your wages are being garnished or your bank account was frozen

-

You haven’t filed taxes for multiple years

-

You’re a 1099 worker or self-employed and fell behind on payments

-

You’re going through divorce, illness, or job loss impacting your finances

❗ Did You Know? Even if you haven’t filed taxes for years, you can still qualify for relief programs once you get back into compliance.

🎯 Why It’s Urgent to Act Now

The longer you wait, the more interest and penalties will pile up.

And if the IRS issues a lien or levy, it can seriously damage your credit and finances.

✅ Your next step:

Talk to a Tax Pro Now (Free Consultation) to see what programs fit your situation.

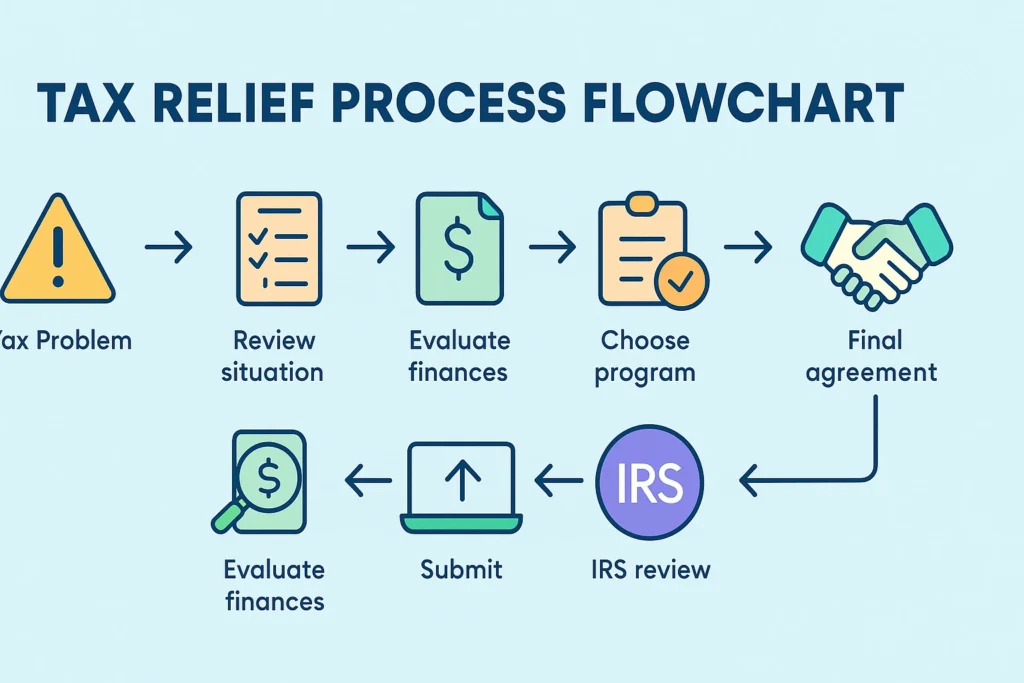

🔄 How Tax Relief Works (Step-by-Step)

If you’re dealing with IRS debt, it’s easy to feel lost.

But don’t worry — tax relief follows a clear process. Whether you’re applying directly or hiring help, the general steps are the same.

Here’s a simplified breakdown of what to expect:

🪜 Step-by-Step: How Tax Relief Usually Works

-

Initial Review of Your Tax Situation

A tax relief process always begins with gathering the facts — how much you owe, what kind of debt it is, and how long it’s been outstanding. -

Getting Into Compliance

If you haven’t filed taxes for recent years, the IRS will require you to get current before you can qualify for any resolution. -

Financial Evaluation

The IRS (or your state) will want to see your full financial picture — including income, expenses, assets, and liabilities.

This determines what relief options you might qualify for. -

Choosing the Best Resolution Strategy

Based on your finances, you’ll explore which program fits you best:-

Monthly payments?

-

Temporary hardship status?

-

Settle for less?

-

-

Submitting the Proposal to the IRS

This is the official step — sending in a formal request (with documentation) for a resolution like an Offer in Compromise or an Installment Agreement. -

IRS Review + Negotiation (if needed)

The IRS may accept, reject, or counter your proposal.

Professionals often handle this part, but you can also DIY if you’re comfortable with paperwork and IRS processes. -

Final Approval + Ongoing Compliance

Once a resolution is accepted, you’ll need to follow the terms closely.Missing a single payment or filing late could cancel the agreement.

📋 What You’ll Typically Need:

-

Recent tax returns (last 2–3 years)

-

IRS account transcripts

-

Proof of income and living expenses

-

Bank and asset documentation

⚖️ Can You Do This Alone?

Technically, yes — but the paperwork is complex and IRS rules are strict.

That’s why many people turn to licensed professionals or tax relief companies for help.

🧩 Not sure where to start?

👉 Compare Top Tax Relief Companies Here – see which provider fits your situation and budget.

⚙️ Tax Relief Options Explained

Once your financials are reviewed, the next step is choosing the right tax relief option. The IRS doesn’t offer a one-size-fits-all solution — instead, there are several programs based on your income, assets, and hardship level.

Here’s a quick comparison of the most common tax relief options:

| 🧩 Program | 💡 What It Does | 👤 Who It’s For |

| Offer in Compromise (OIC) | Lets you settle your tax debt for less than you owe | You can’t afford to pay the full amount and meet strict IRS criteria |

| Installment Agreement | Set up a monthly payment plan with the IRS | You can afford to pay but need more time |

| Currently Not Collectible (CNC) | Temporarily halts IRS collections | You’re in financial hardship and can’t pay anything right now |

| Penalty Abatement | Requests reduction or removal of IRS penalties | You had a valid reason for falling behind (e.g., illness, disaster) |

| Innocent Spouse Relief | Removes responsibility for a spouse’s tax errors | You’re being unfairly held liable for your spouse or ex’s actions |

🧠 A Few Things to Know:

-

OIC approvals are rare (only about 30–40% of applicants get accepted).

-

Payment plans are the most common solution for most taxpayers.

-

You must stay compliant going forward — file and pay on time.

💬 Still unsure which program applies to you?

👉 See the Best Tax Relief Companies to Help You Choose

✅ Do You Qualify for Tax Relief?

Not everyone qualifies for tax relief — but many do.

To find out if you’re eligible, you’ll need to take a close look at your income, assets, monthly expenses, and total tax debt.

Here’s a checklist to help you gauge your chances:

🔍 You May Qualify If:

-

You owe more than $10,000 in IRS or state back taxes

-

You can’t afford to pay the full amount without hardship

-

You’ve experienced a job loss, divorce, or medical issue

-

You’ve fallen behind due to self-employment taxes or missed filings

-

You’re willing to get into compliance with current-year taxes

❌ You May Not Qualify If:

-

You can afford to pay in full or near full

-

You’ve already defaulted on a previous relief agreement

-

You haven’t filed taxes in several years and aren’t willing to catch up

📌 What the IRS Looks At:

-

Monthly income vs. living expenses

-

Home equity, retirement accounts, and other assets

-

Filing compliance and payment history

-

Willingness to cooperate

🧑💼 Should You Use a Tax Relief Company?

You can handle tax relief yourself — but that doesn’t mean you should.

IRS rules are complicated, and making a mistake can delay or derail your entire case. That’s why many people choose to work with a tax relief company or licensed tax pro to handle the paperwork and communication.

✅ Pros of Using a Tax Relief Firm:

-

They know how to negotiate with the IRS

-

They’ll help gather and prepare your documents

-

You avoid direct IRS contact

-

They save you time (and stress)

⚠️ Cons to Be Aware Of:

-

Fees usually range from $1,500 to $5,000+

-

Not every company is reputable

-

No company can guarantee results

🚩 Red Flags to Watch Out For:

-

Promises to “wipe out your tax debt” no matter what

-

High-pressure sales tactics or large upfront payments

-

No mention of licensed professionals like CPAs or Enrolled Agents

🛡️ Play it safe.

👉 Compare Trusted Tax Relief Providers Before You Commit

🧭 What to Expect from Tax Relief (Realistically)

Tax relief can be life-changing — but it’s not magic.

It’s important to go in with clear expectations so you’re not caught off guard or misled by aggressive marketing.

Here’s what to know before you begin:

⏳ It Takes Time

Most tax relief cases take 3 to 9 months to resolve.

If your case is complex or involves multiple years of unfiled returns, it could take even longer.

The IRS moves slowly — even when your issue feels urgent.

💰 It Doesn’t Always Erase Your Debt

Some people qualify for major reductions.

Others are offered a payment plan or temporary pause.

The outcome depends on:

-

Your ability to pay

-

The accuracy of your documentation

-

Whether you’ve had previous tax issues

📑 You’ll Still Need to File & Pay Taxes in the Future

Once you’re in a resolution plan, you’re expected to:

-

File your taxes on time every year

-

Make all required payments moving forward

Missing a payment or failing to file again could void your agreement and put you back in collections.

🧠 Bottom line? Tax relief is a tool — not a “get out of taxes free” card.

🎯 Ready to take the next step?

👉 Compare the Top Tax Relief Companies to See What Fits You Best

🧩 Alternatives to Tax Relief Companies

Working with a tax relief company can be helpful, but it’s not your only option. Depending on your situation and budget, you might consider these paths instead:

📝 1. Handle It Yourself with the IRS

The IRS offers Form 9465 for payment plans and Form 433-A/OIC for Offers in Compromise.

If you’re confident handling paperwork and negotiations, you can DIY the process through irs.gov.

Pros: No fees

Cons: Complex forms, risk of errors, no negotiation help

🧑🏫 2. Work with a Local CPA or Enrolled Agent

Licensed tax professionals can help you explore relief options and file forms properly.

Look for someone with experience in:

-

IRS collections

-

Tax resolution

-

Audit representation

💸 3. Use a Low-Income Taxpayer Clinic (LITC)

If you’re struggling financially, an LITC may be able to help for free or at very low cost.

These nonprofit clinics assist eligible taxpayers with:

-

IRS disputes

-

Audits

-

Appeals

-

Collection issues

You can find one near you via the IRS LITC directory.

🧭 Which Path Should You Take?

Choosing between self-help, a local pro, or a relief company depends on:

-

How much you owe

-

How complex your case is

-

How confident you feel dealing with the IRS

🏁 Conclusion: Take Control of Your Tax Situation Today

Falling behind on taxes can feel overwhelming — but you don’t have to navigate it alone.

Now that you understand how tax relief works, what your options are, and what to expect, you’re in a much stronger position to take action.

Whether you need a payment plan, a reduced settlement, or just help getting compliant again, there’s a solution that fits.

🎯 The first step?

👉 Compare the Top Tax Relief Companies to Find the Right Fit for You

These providers have experience negotiating with the IRS and can help you move forward with confidence — not fear.

❓ Frequently Asked Questions

🤔 What is the IRS Fresh Start Program?

The IRS Fresh Start Program is an initiative launched in 2011 that makes it easier for taxpayers to qualify for relief programs like Offer in Compromise and Installment Agreements. It’s still active in 2025 and is the foundation of most tax relief efforts.

💸 Can I really settle my tax debt for less?

Yes — through a program called Offer in Compromise. But it’s not guaranteed. The IRS will only accept a reduced amount if you truly can’t afford to pay the full debt based on your income, assets, and expenses.

⏱️ How long does the tax relief process take?

On average, 3 to 9 months, depending on your case complexity and how responsive the IRS is. Gathering paperwork and waiting for IRS review often takes the most time.

📂 What documents do I need for tax relief?

You’ll typically need:

- Past tax returns

- IRS notices

- Proof of income and expenses

- Bank and asset statements

- Identification documents

🧑💼 What does a tax relief company actually do?

A tax relief company evaluates your situation, helps you get compliant, prepares all forms, and negotiates directly with the IRS on your behalf. This saves you time, reduces stress, and increases the chance of getting a better resolution.